tax credit college student

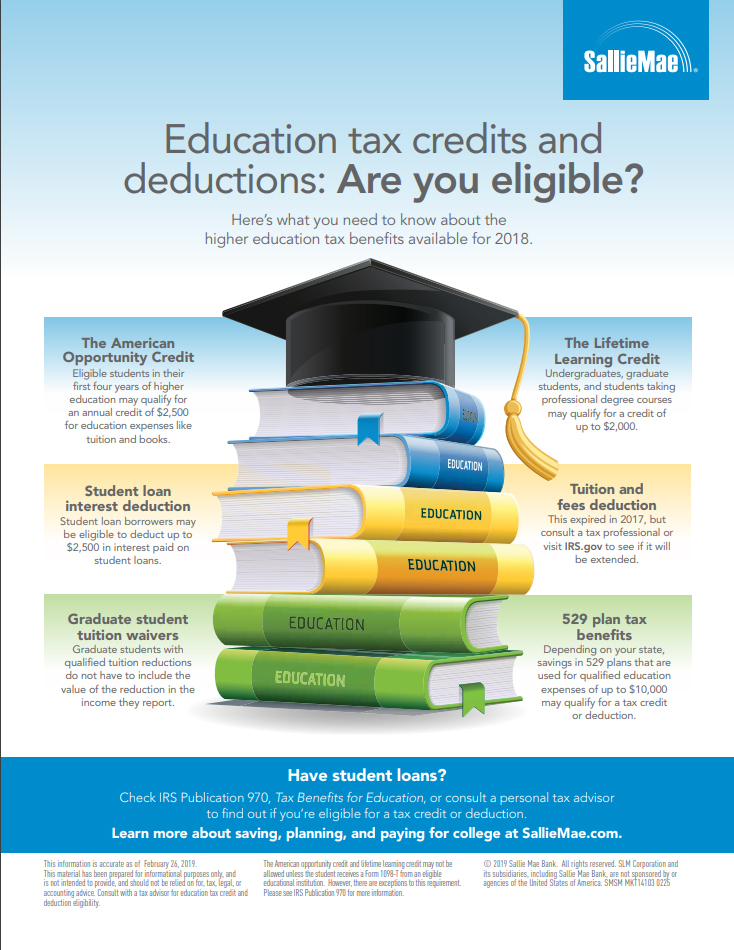

Mercer County Community College 1200 Old Trenton Rd West Windsor NJ 08550-3407 609 586-4800. Education Tax Credit 1 The American Opportunity Tax Credit The first tax credit available to college students is the American Opportunity Tax Credit or AOTC.

Higher Education Tax Benefits Do You Qualify Business Wire

Students from other four-year institutions can transfer in up to 96.

. There are two additional tax breaks that students in college or their parents and guardians might benefit from. 6095864800 Maps and Directions. However you are able to claim for.

It is reimbursable for up to 1000. Confusion Surrounding Transfer Credits. The credit offers up to 100 percent of the first 2000 of qualified expenses and 25 percent of the next 2000.

Conference Center at Mercer. What is child tax credit. It allows you to claim 100 of the first 2000.

Students with an Associate in Arts AA or an Associate in Science AS Degree can transfer in a maximum of 64 credits. College students can get up to 2500 annually with the AOTC. 5 rows If you qualify you could get a credit for 100 of the first 2000 of qualified education.

The American opportunity tax credit is. Only for the first four years at an eligible college or vocational school. Visit our Income Tax Guide for College Students and find out about.

Browse reviews directions phone numbers and more info on Tax Credits LLC. Child tax credit is part of the America rescue plan 2021 the largest child tax credit in history 2000-3000 per child over the age of 6 and 3000-3600 per child. The American Opportunity Tax Credit is available for first-time college students during their first four years of higher education.

For 2022 Returns the American Opportunity Credit and Lifetime Learning Credit are the two federal tax credits available for students and parents of students. American Opportunity Tax Credit. If you are a self-declared college student you can claim this credit up to four times.

The American Opportunity Tax Credit AOTC and the Lifetime. Qualifying students can receive credits of up to 2500 per year. It is important to remember that the Child Tax Credit for college students is a one-time payment rather than a recurring monthly paycheck.

A July 2021 report from the Community College Research Center CCRC revealed that even though many students start community. Worth a maximum benefit up to 2500 per eligible student. Because a tax credit reduces your.

The college student tax credits include the. The AOTC is a tax credit of up to 2500 per year for an eligible student. The credit covers 100 of the first 2000 in approved expenses and 25 of the second 2000 in expenses.

WWFM The Classical Network. 5 hours agoGreene-Lewis reveals tax tips about the American Opportunity Tax Credit Lifetime Learning Credit student loan deduction 1099-K rules and more. Business profile of Tax Credits LLC located at 45 Knightsbridge Road 22 Piscataway NJ 08854.

Read the full QA below or. The American opportunity tax credit AOTC previously called the Hope College credit is valued at 2500 for 2022 up from 1800 in 2008.

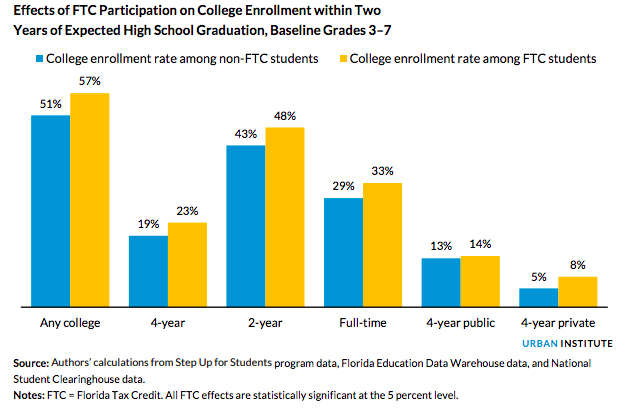

New Florida Study Shows Students Using State S Tax Credit Scholarship Program More Likely To Attend And Graduate College The 74

College Student Eligibility For Child Tax Credit Don T Miss Your 500 Payment Next Month Gobankingrates

Have A College Student You May Be Getting A 500 Payment Next Month

Now Is The Time To Consider College Tax Credits For 2015 And Beyond Dsj Cpa

Tax Benefits For College Students Credit Union Student Choice

An Infographic Look At Education Tax Credits Cheapscholar Org Cheapscholar Org

Publication 970 2021 Tax Benefits For Education Internal Revenue Service

2022 College Tuition Tax Deductions Smartasset

Tax Information Wilson Community College Wilson Nc

American Opportunity Tax Credit 2018 Tax Tips For College Students College And Taxes Part 1 Of 2 P Youtube

Tax Deductions For College Students 2018 Youtube

4 College Tax Deductions And Credits For Students And Their Parents

Tax Breaks For College Students And Parents Bestcolleges

Maximizing The Higher Education Tax Credits Journal Of Accountancy

New Sc College Tax Credit In Effect

Educate Your Student About Credit Cards Collegiateparent

Tax Planning Strategies Tips Steps Resources For Planning Maryville Online

Maine Expands Student Loan Tax Credit Marcum Llp Accountants And Advisors

Cefa On Twitter With The College Access Tax Credit Program Recently Opening For Taxable Year 2021 Anyone Can Help College Students Succeed Through Cal Grants Disbursements While Receiving A Tax Credit Of